SKIP TO LIVE BITCOIN HALVING 2024 COUNTDOWN!

As we gear up for the much-anticipated Bitcoin Halving 2024 scheduled now for April 2024, the crypto sphere is buzzing with excitement and speculation.

This event, a periodic Bitcoin Halving of the reward for mining Bitcoin transactions, is a game-changer that’s got hodlers, traders, and enthusiasts on the edge of their seats!

So, let’s take a deep dive into the top 5 strategies savvy crypto buffs are employing to prepare for this seismic shift in the digital currency landscape.

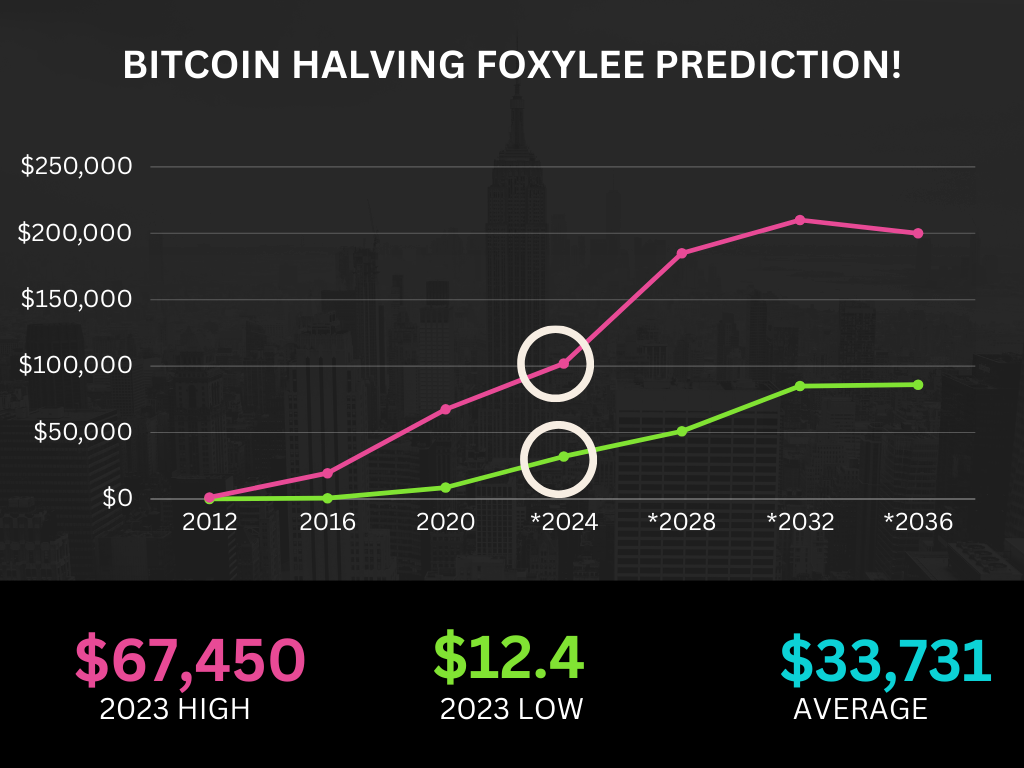

Confused with all the current Bitcoin Halving graphs, I made my own…

- Strategic Buys: Timing the Market with Precision – Crypto aficionados know that timing is everything. As we approach the halving, many are sharpening their strategies to ‘buy the dip.’ It’s all about accumulating more BTC at lower prices before the halving triggers a potential price surge.

- Selling with Finesse: Profiting from Peaks – The halving often leads to a bullish run, and seasoned crypto traders are ready to capitalize. They’re setting strategic sell orders to take profits at key resistance levels. It’s not just about selling; it’s about maximizing gains and knowing when to exit before the market adjusts post-halving.

- Day Trading Dynamics: Riding the Volatility Waves – Day traders are in their element, leveraging the increased volatility that comes with halving events. They’re employing both long and short strategies, using tools like leverage and futures to amplify their trades. The goal? To snatch profits from the rapid price movements while managing their risk with stop-loss orders.

- Bot Trading: Automating the Hustle – In the digital age, why trade manually when bots can do it for you? Many crypto gurus are setting up sophisticated trading bots to execute trades automatically based on predefined criteria. These bots are the unsung heroes, tirelessly working to capitalize on market movements 24/7, ensuring no opportunity is missed. When I was able to use Binance, Bitsgap was a killer trading software. My only complaint was that it was pricey for 5 side grid bots, almost $100/monthly.

- Portfolio Diversification: Balancing the Crypto Scales – Wise hodlers know not to put all their eggs in one blockchain basket. They’re diversifying their portfolios by investing in a mix of altcoins AKA Sh*itcoins, stablecoins, and even venturing into DeFi projects. This not only mitigates risk but also positions them to benefit from potential gains across the broader crypto market while they fasten their seatbelt for the Bitcoin halving.

Profit Expectations: To the Moon? Post-halving, the crypto community is often bullish about profit potentials. The historical trend below, shows a significant price increase months after a halving. But remember, in the world of crypto, volatility is the only constant. Profits aren’t guaranteed, but the opportunities are vast. Many financial analysts in the DeFi space are predicting way higher or lower figures than mine, so it should be fun to revisit this editorial in April 2024. ..

| Lowest price | Highest price | |

|---|---|---|

| First halving cycle (November 2012 – July 2016) | $12.4 (December 2012) | $1,170 (November 2013) |

| Second halving cycle (July 2016 – May 2020) | $535 (August 2016) | $19,400 (December 2017) |

| Third halving cycle (May 2020 – April 2024)* | $8,590 (May 2020) | $67,450 (November 2021) |

As we count down to the Bitcoin Halving of 2024, the buzz is real, and the stakes are high. Crypto enthusiasts are not just preparing; they’re strategizing, analyzing, and automating their way to what could be the next big bull run. So, buckle up, hodlers! The journey to the moon is just getting started. 🚀🌕

Curious from when I started my crypto journey? Time Machine here.